Is it required to check VAT numbers?

Every quarter, EU businesses selling telecommunications, broadcasting and electronic services (TBE) to business customers in another Member State have to file an EC Sales List (ESL). The customer (i.e. their VAT number) quoted in the ESL must be correct.

Vatstack allows you to check if the VAT number provided by your customer is registered in the relevant national database. The valid VAT number of your customer should be mentioned on your invoice.

Which countries do you currently support?

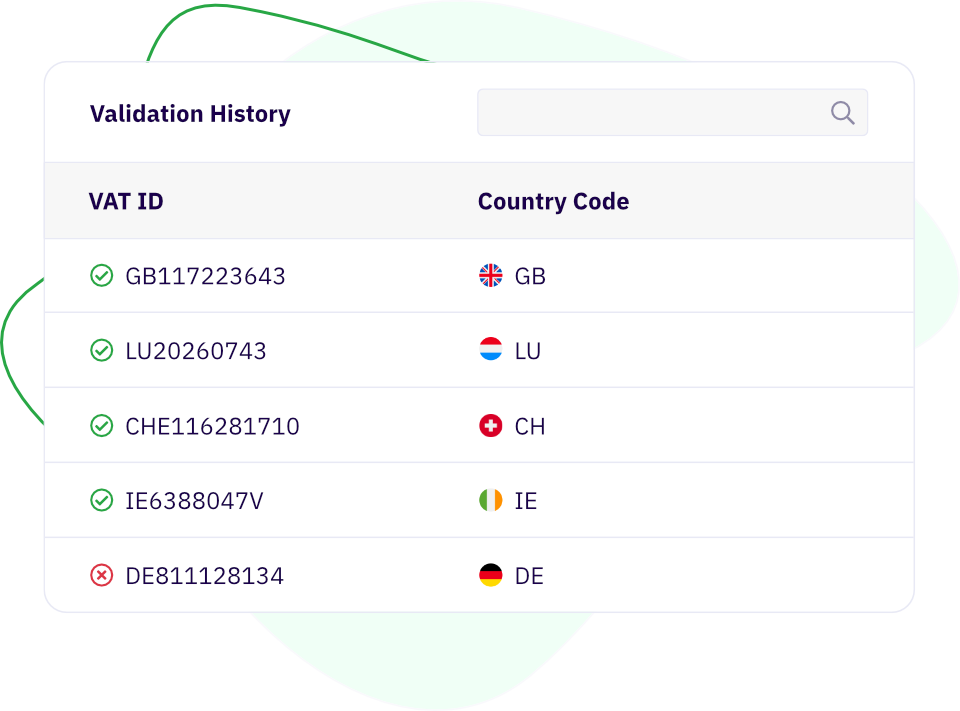

You can verify VAT & GST registration numbers of all businesses in the 27 EU member states eu_vat, Australia au_gst, Norway no_vat, Singapore sg_gst, Switzerland ch_vat, and the United Kingdom gb_vat in real-time.

Support for more countries is following at a rapid pace. Please contact us if you have a particular requirement and we will try to prioritize it.

Where is the data coming from?

Our data is sourced directly from official government databases, including the VAT Information Exchange System (VIES) operated by the European Commission.

Do I have to check VAT & GST numbers regularly?

Outdated customer data costs you money. If your customer’s VAT number expires you should ask for their new VAT number. Otherwise the reverse-charge mechanism no longer applies and you have to start charging VAT at your customer’s local rate. Therefore, VAT-registration statuses must be checked regularly.

It is your duty to ensure that the reverse-charge mechanism continues to apply to your B2B supplies and that changes to their circumstances are reflected in your invoices. You can use our bulk validation facilities to import all your customer’s VAT numbers in a CSV for re-validation.

Why should I use Vatstack?

You may, of course, validate VAT numbers against the individual government services directly but will quickly realize that you need to build several other functions revolving around VAT validation.

Ambitious companies underestimate the business logic and maintenance behind handling VAT and validating their customer’s VAT numbers. Vatstack ships with a lot of intelligent features to help you save time and focus on your company’s core mission.

Are VAT numbers required in invoices?

In the EU, stating your own and your customer’s VAT numbers in invoices are a substantive requirement for zero-rating VAT. Tax administrations may also reason that you should take reasonable steps to avoid becoming involved in any VAT fraud. You should therefore take all practical measures to verify your customers’ VAT numbers.

We’ve made it especially easy for you to validate VAT numbers automatically. A lot of business logic is already built-in and made available to you via API.

Can I bulk validate VAT & GST numbers?

Yes, you can validate VAT numbers in bulk. Use the batches feature in your dashboard to perform bulk validations.

Do I need to register for VAT if my business is outside the EU?

All businesses (or individuals carrying out an economic activity) situated outside the EU selling to EU customers need to register for VAT and obtain a free VAT number. Unfortunately, there are no exceptions to these VAT obligations and no de minimis thresholds for turnover or transaction volumes.

Ignoring VAT is not a good idea. Every country in the EU enforces tax requirements themselves via audits, which can include receipts sent in by your customers (who send them in because they are entitled to tax refunds on certain goods). This is where a non-compliance could be picked up.

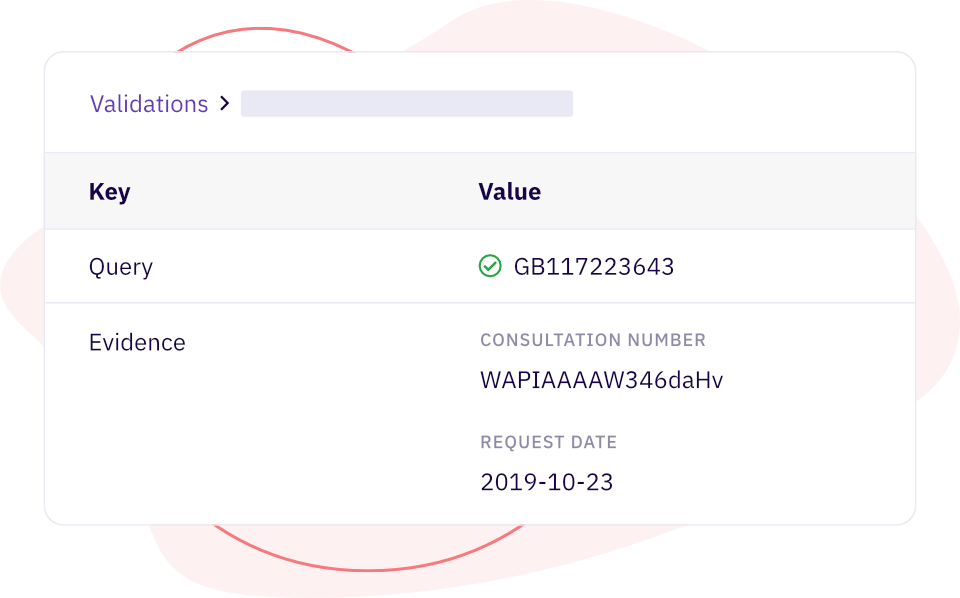

What are consultation numbers?

If you want to be able to prove to a tax administration of a member state that you have checked a given VAT number on a given date, and obtained a given validation reply, please keep this consultation number in your archives.

Vatstack will collect and store a consultation number and its request date on your behalf if you save your VAT number in your account settings.

What if I exceed my monthly validation limit?

You will be automatically notified if your validation requests exceed 75% of your monthly included capacity. Requests beyond the monthly included capacity are billed on a metered per use basis.

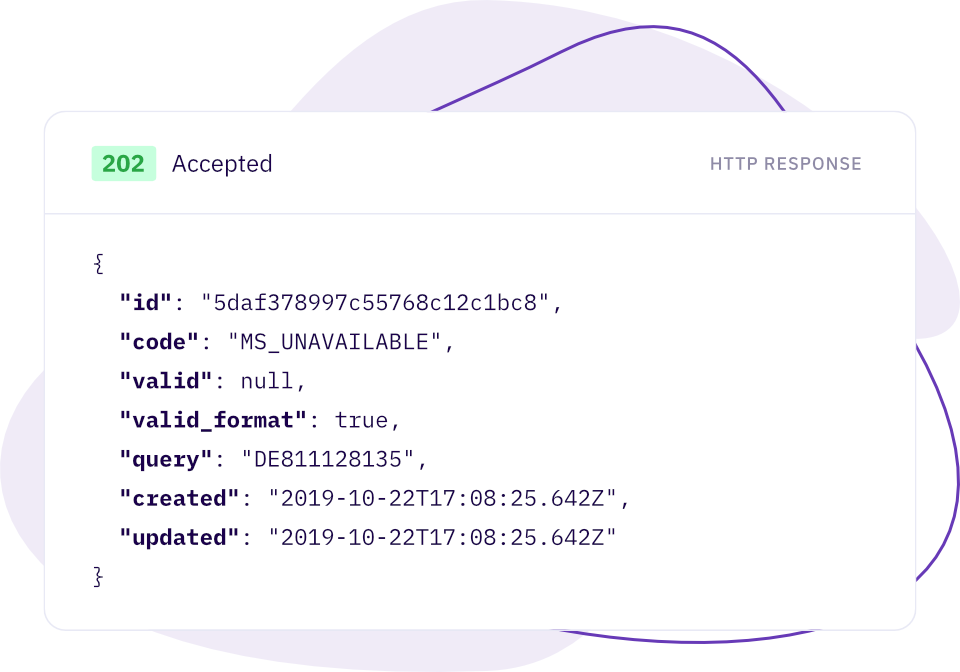

How do you handle government service downtimes?

Government databases can experience regular downtimes for maintenance. A typical fault code during downtime is SERVICE_UNAVAILABLE. Vatstack will gracefully accept VAT number check requests and continue the process asynchronously in the background. Once a result is obtained, it is sent to your server via webhook events.

Simply add an API endpoint to your web application to receive webhook events. Once Vatstack has obtained a response from government databases, it will automatically post the response to that endpoint. This allows you to save your customer’s VAT number and asynchronously validate it afterwards.

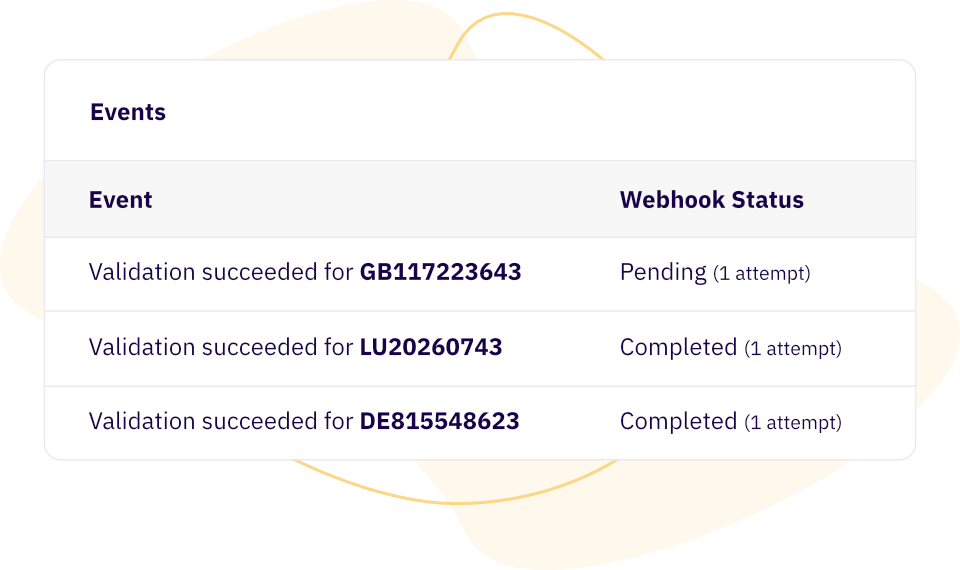

Can I get notified if a VAT number is no longer valid?

Yes. You can listen to webhook events whenever a validation request was successfully processed. A bulk VAT validation process also creates a validation record for every VAT number.

Our API will send you a validation.succeeded webhook event which you can further process on your end. For example, to send out an automated email to your customer requesting an update or to suspend the reverse-charge mechanism.

How do the event webhooks work?

A VAT number check usually takes only a few milliseconds, but depending on the availability of various government databases, it may also take longer. Vatstack automatically handles downtimes and attempts retries for you. This means that you can provisionally obtain your customer’s VAT number and asynchronously validate it afterwards.

In your dashboard, you can set an API endpoint of your web application at which you want to receive HTTP POST requests at. These requests contain the payload of the validation result.