How reliable are your VAT rates?

Our team closely tracks changes to the VAT rates stored our database and adjusts them whenever governments announce new legislations. Any changes take effect at exactly midnight local time. Digital businesses across industries subscribe to our rates, so you’ll be in good company.

How often should I lookup VAT rates?

We recommend that you synchronize with our rates at a regular interval to ensure that your application stores the correct VAT rates. You can let Vatstack keep your VAT rates up-to-date by connecting with your favorite payment processor.

Changes by governments generally take effect at the beginning of a quarter or month. If you fetch VAT rates manually, a daily update is sufficient.

Do I need to charge VAT?

Governments want to ensure that they receive taxes on all goods and services consumed by their citizens. Physical products are taxed at customs. Digital products don’t cross any borders to pass through customs, so you are made responsible to charge the applicable VAT.

As a supplier of electronically supplied services (i.e. digital products) to EU customers, you’re responsible for applying, collecting and remitting VAT to the individual 27 member states at their various VAT rates (Article 196 VAT Directive). It is regardless whether you are supplying goods and services from within or from outside the EU.

What are digital products or services?

The digital market is full of virtual products that you can’t feel, carry, or package in a box. These are the digital products or services. The European Commission calls them electronically supplied services and defines them as “services which are delivered over the Internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology.”

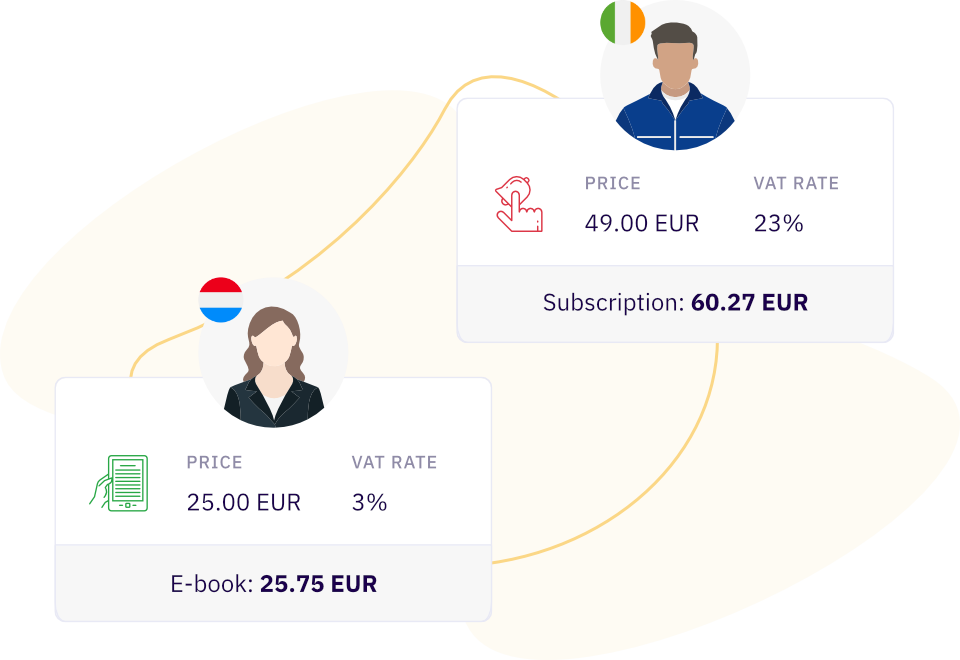

Certain digital products can be eligible to a reduced VAT rate in some EU countries. Here are examples for electronically supplied services:

- E-books, audiobooks, stock photos, movies, and videos, whether buying a copy off of Amazon or using a service like Netflix. In tax language, these products are in a category usually called, “Audio, visual, or audio-visual products.”

- Cloud-based software and as-a-Service products, such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS).

- Downloadable and streaming music, whether buying an MP3 or using a service like SoundCloud or Spotify. Of course, these products also fall in the audio category.

- Websites, site hosting services, and internet service providers.

When should I charge EU VAT?

It depends on where you and your customer are located. We’ve written a comprehensive overview of the VAT rules. A business customer is exempt under a reverse-charge mechanism, but you are responsible for validating their VAT number first.

In particular, a business must register for VAT in the following cases:

- carries out the supply of goods or services taxed with VAT

- transacts goods from one EU member state to another EU member state

- receives services for which it is liable to pay VAT (Article 196 VAT Directive)

- supplies services for which the customer is liable to pay VAT (Article 196 VAT Directive)

Do I need to issue an invoice?

EU regulations state that you need to issue an invoice either electronically or on paper whenever you supply goods, render services, or receive payment on account. If you’re issuing electronically, make sure to let the customer know in advance that you won’t be sending a hard copy.

Are there exceptions to charging VAT?

When you make a sale to a customer in the EU, request the customer’s VAT number. Most businesses (or individuals carrying out an economic activity) will have one, private individuals will not. Some buyers may try to pretend they’re a business just to avoid the tax charge, so they’ll submit a dummy VAT number. Ensure that each VAT number is valid. You can use Vatstack Validations to automate checks during online payment.

If your customer owns a valid VAT number, you’re exempt from charging VAT in intra-community (EU) and cross-border (international) supplies. The transaction is covered by the reverse charge mechanism. With the reverse charge mechanism, the buyer is responsible for filing VAT on the transaction.

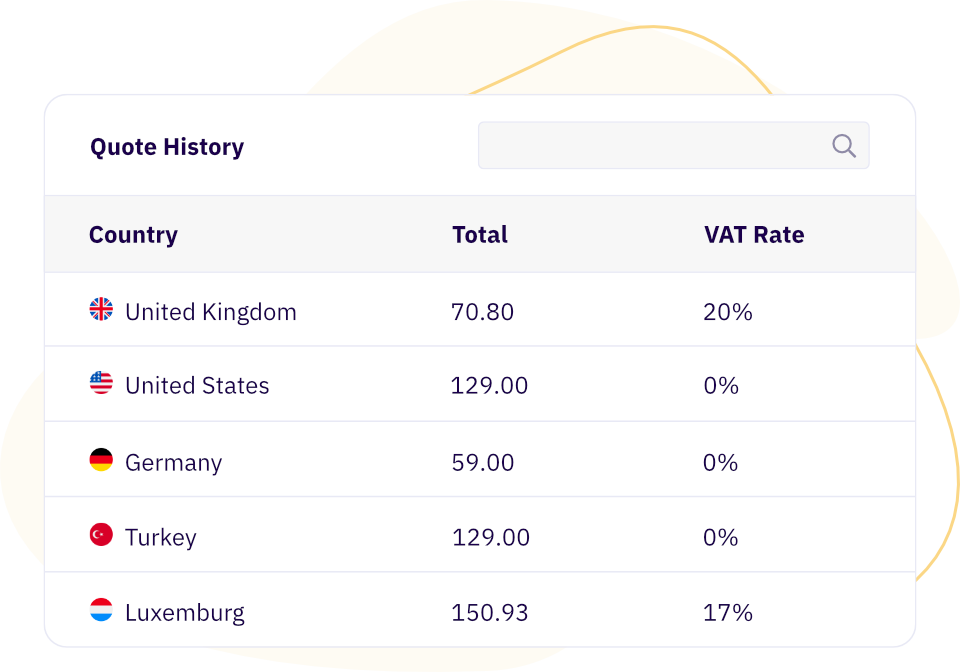

How are price quotes generated?

Price quotes are used during your customer’s checkout. They are generated based on the data we have about your business and match it with the data that you provide about your customer during checkout. Configure a few tax treatment settings in your dashboard and you’re good to go.

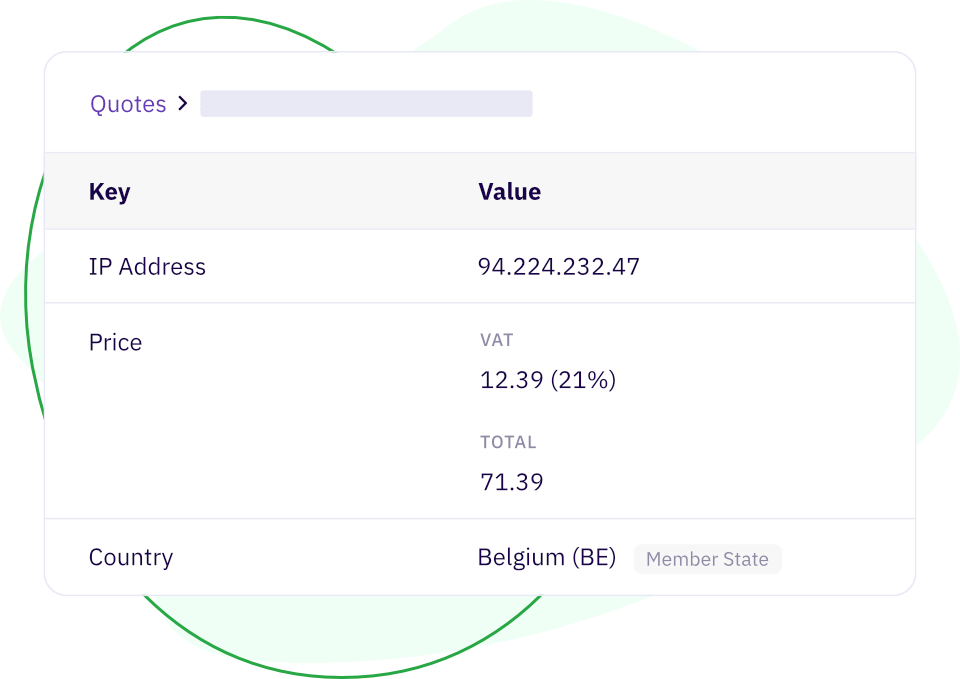

How are customers geolocated?

We use MaxMind® GeoIP2 geolocation technology to locate customers based on their IP address. You can either include your customer’s IP address in your API request or let your frontend application send the request to us directly.

Should MaxMind® unexpectedly fail to deliver a response, we utilize several fallback providers to ensure that you’re always able to geolocate your customer.