How to Check and Validate EU VAT Numbers

Digital products are exempt from EU VAT if you sell to customers that are businesses themselves. A wrong VAT number submitted by your customer may invalidate your invoice. This guide shows how you can validate the VAT number of your customer.

Matt HagemannPublished July 28, 2019

If your customer is a business like you, they’ll expect not to pay VAT and likely have a VAT number to prove it. All you need to do is verify if they are really a business before zero-rating VAT.

What is a VAT Number

The VAT number is a unique code which a business is given when it registers itself with a tax authority in the European Union.

As the supplier you must state your customer’s validated VAT number on the invoice. This means that you should re-validate VAT numbers whenever a scheduled charge becomes due (for example on a subscription model).

Some EU member state databases do not disclose the business’s name and address for privacy reasons, so you’ll have to trust that your customer is providing its own VAT number.

Why You Have to Validate EU VAT Numbers

Online businesses are unlike brick and mortar stores. If a physical product enters the EU, it is taxed at the customs. Digital products obviously don’t cross any borders that can pass through customs, so they have VAT added. Digital products are any Telecommunication, Broadcasting and Electronic (TBE) services, or collectively called electronically supplied services (ESS). We’ve written more information about such electronically supplied services.

If foreign businesses didn’t have to charge a VAT, imagine how disadvantaged EU-based businesses would become. Their products and services would cost more to the consumer.

Lawmakers have therefore decided that businesses themselves will be held accountable for charging the correct VAT to all their EU citizens. This is regardless whether your business is operating from within or from outside the EU.

Customers can pretend to be a business just to avoid taxes, and you will end up owing the VAT amount to tax administrations.

A customers who cannot provide a VAT number must be charged a VAT at the rate applicable at their location. It will no longer be possible to exempt VAT as of January 1, 2020 without a validated VAT number of your customer stated on the invoice. A customer’s valid VAT number is a substantive requirement for applying the zero VAT rate to intra-community supplies of goods.

Note that the chargeable event for digital products takes place at the customer’s location, not your business’s location. We’ve written about the VAT rules in the European Union for your reference. For example, if your customer is normally residing in Belgium, you would have to charge the Belgian VAT rate of 21% (reduced VAT rates may apply for certain types of digital products).

How to Validate the EU VAT Number of Your Customer

When you check a VAT number, your request goes to the database of the respective EU member state in real-time. This mechanism is made possible by the VAT Information Exchange System (VIES) of the European Commission. If the number appears invalid, you should either reject it or contact your customer to rectify the situation.

There are two ways to validate EU VAT numbers:

1. Manually

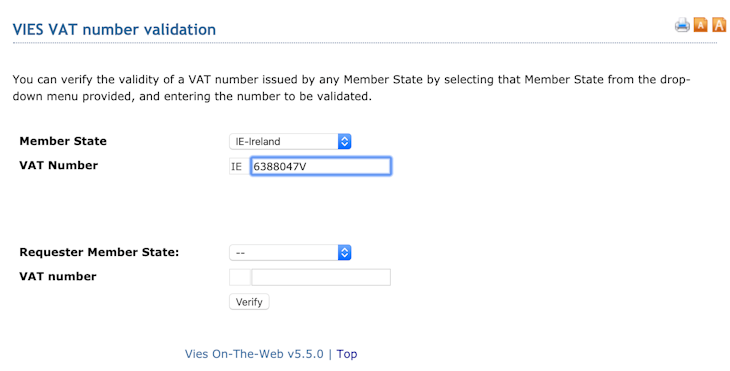

The status of a EU VAT number issued by any EU country can be manually checked via VIES. VIES checks the registration status of EU VAT numbers against the records maintained by the respective member state. Select the country code (member state) where your customer resides and enter the VAT number.

If you have a VAT number yourself, you can enter it in the fields underneath. This will additionally request a unique reference number which is a piece of evidence showing that you have validated a given VAT number on a given date.

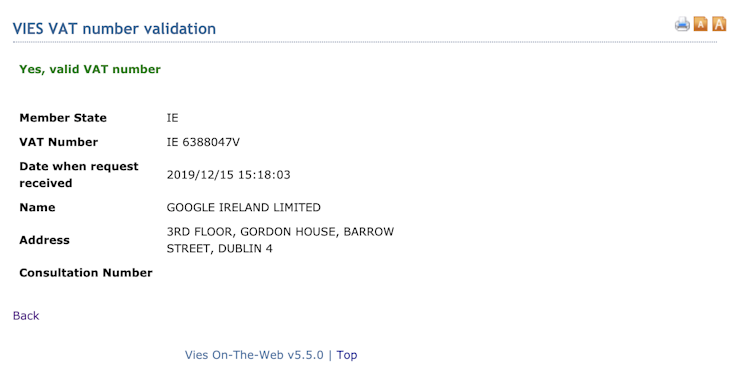

Click the Verify button to obtain a response:

2. Automatically

In order to automate VAT number checks during your customer’s checkout process, you would implement an API. Most online businesses selling digital products have an automated process to validate their customer’s VAT number during checkout. This gives customers immediate feedback when they enter an invalid VAT number, and saves you manual work.

Our validations REST API lets you validate VAT numbers in real-time. Responses are returned to you in JSON format.

A JSON response for VAT number IE6388047V will look like this:

{

"id": "5d1ded3128ca7a842aaf5ed4",

"company_address": "3RD FLOOR, GORDON HOUSE, BARROW STREET, DUBLIN 4",

"company_name": "GOOGLE IRELAND LIMITED",

"company_type": null,

"consultation_number": "WAPIAAAAW21qsOHW",

"country_code": "IE",

"query": "IE6388047V",

"type": "eu_vat",

"valid": true,

"valid_format": true,

"vat_number": "6388047V",

"requested": "2019-07-04T00:00:00.000Z",

"created": "2019-07-04T12:12:33.322Z",

"updated": "2019-07-04T12:12:33.322Z"

}3. Automated Mass Validation

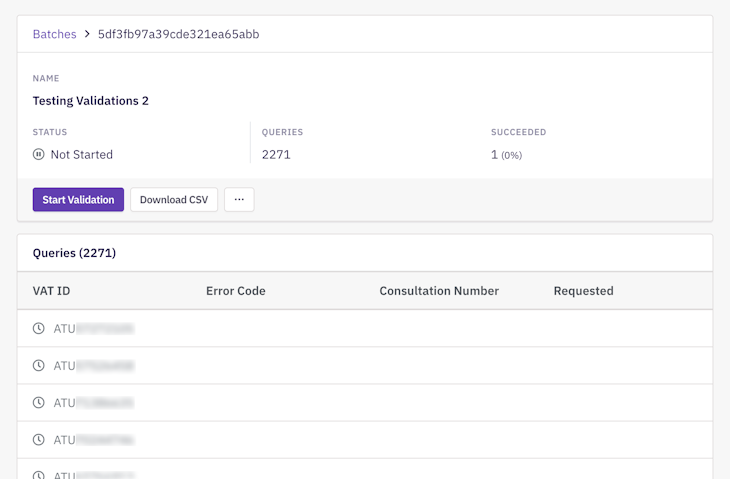

If you have to check a large number of VAT numbers at a time, you can use our dashboard to check VAT numbers in bulk.

Upload a CSV file and start the validation process. Once finished, you’ll be notified via email and can download the complete report containing VAT registration status and official company data.