How to Create and File VAT OSS Reports

This guide explains what steps are required to create and file a correct VAT OSS report (formerly VAT MOSS) and how you can automate the entire process.

Matt HagemannPublished June 8, 2020

VAT OSS is a simple VAT filing mechanism of the EU whereby a designated One-Stop Shop (OSS) acts as an intermediary for collecting and forwarding VAT to the respective EU Member States. You pay to a single tax office of your choice and the tax office allocates the funds for you.

Its predecessor MOSS (meaning Mini One-Stop Shop), an optional digital services scheme, has been converted into OSS on July 1, 2021.

This guide assumes that you are already registered for VAT and have obtained a unique OSS identification number for your business.

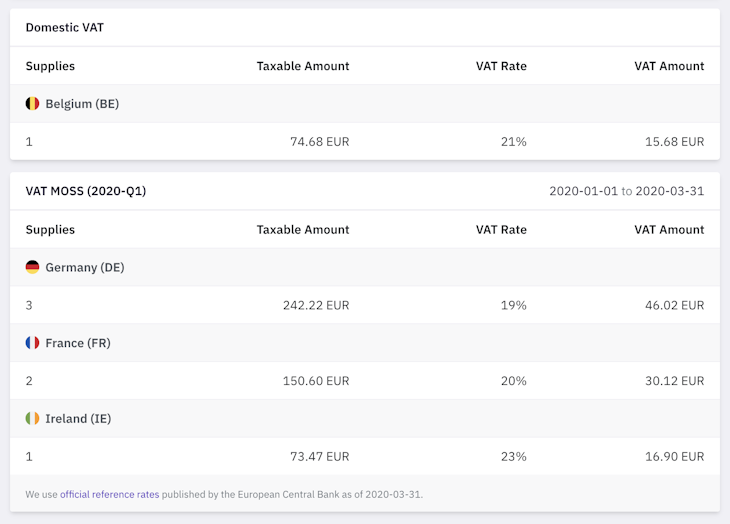

Filing the quarterly report is fairly simple, but compiling it in the first place can be cumbersome. Vatstack lets you synchronize your invoices on Stripe and can automatically generate VAT OSS reports for you.

If you’re doing this manually, here is what you need to consider.

When to file VAT OSS returns

Since you’re collecting the VAT on behalf of the government, you also need to remit the amounts regularly.

VAT remittance is performed on a quarterly basis and submitted electronically no later than the 20th day following the end of the calendar quarter:

- 1st calendar quarter by 20 April,

- 2nd calendar quarter by 20 July,

- 3rd calendar quarter by 20 October,

- 4th calendar quarter by 20 January (of the following year).

Even if no sales were carried out in the relevant calendar quarter, you must still file a “nil return” just to keep the tax office in sync. You can find more information about the deadlines and the recommended due diligence.

What to include in the return

The VAT OSS return is commonly prepopulated with basic details about your business such as your OSS registration number and the relevant calendar quarter.

While systems can differ from Member State to Member State, you will usually find

- a drop-down menu that allows you to select the Member States to which you have made supplies,

- the applicable VAT rate(s) of that Member State

- and an input field to enter the amount of supplies to that Member State.

In order to fill out the form, you should therefore prepare and collect all supplies you have transacted to end consumers throughout the previous quarter. It’s advisable to centrally store transacted supplies for book-keeping purposes.

You don’t have to declare individual supplies in the return. You merely declare the total amount of supplies in each respective Member State and VAT rate. If you’re using Stripe, you can connect it to Vatstack and have upcoming invoices synchronized.

How to convert foreign currencies

Not every Member State in the EU has a reporting currency in Euro. Denmark, for example, requires reports in Danish Krones. Amounts must be converted to the reporting currency at the correct exchange rate. This is also necessary if you’re charging for your products and services in a currency other than the reporting currency.

Apply official exchange rates published by the European Central Bank (ECB) and use the rate applicable on the last day of the calendar quarter to which the return relates. Historical exchange rates are available here. Do not use exchange rates offered by other vendors.

That same exchange rate must also be applied if any amendments are made (in the event of credit notes) even if they happen in a subsequent quarter. You must then re-submit the original VAT OSS return.

You should also ascertain the rounding policy of your OSS. Different countries have different approaches to how a return should be calculated. For example, the UK requires rounding to the nearest even pence while Ireland requires rounding down from the half cent.

This means that £0.975 would be rounded to £0.98 in the UK, but €0.975 is rounded to €0.97 in Ireland.

If your currency conversion results in an uneven number, it makes a small difference depending on which of the three rounding options applies: round up, round down, or round to the nearest even cent.

Amending submitted returns

If you make an error in a VAT OSS return and had already filed it, you can amend that return through OSS up to three years after the due date of the return.

Automate VAT OSS reports with Vatstack

You can use Vatstack to completely automate the compiling of your quarterly VAT OSS reports. Simply connect Vatstack with your Stripe account. Upcoming invoices will be automatically converted into supplies which make up your tax report.

Accurate currency conversions with the ECB’s official rates are also done for you and altogether will save you hours of precious time.