Norway VAT Number Validation

Norwegian VAT (MVA) numbers can be validated automatically with Vatstack’s VAT number validation API. You can now check and verify the business information of your customers in Norway. Save time and validate the VAT numbers in bulk.

Matt HagemannPublished February 29, 2020

Businesses selling to customers in Norway are obliged to register with the Value Added Tax Register as soon as their turnover crosses NOK 50,000 (NOK 140,000 for charitable and benevolent organizations).

Only turnover liable for VAT is taken into consideration. This VAT rule applies to businesses regardless of whether they are established in Norway or not.

If you are new to VAT numbers in Norway, check out this guide before you proceed further. It explores the rates and regulations specifically in Norway.

To validate the VAT number, you can do it manually (the hard way) or automatically.

Check a VAT Number Manually

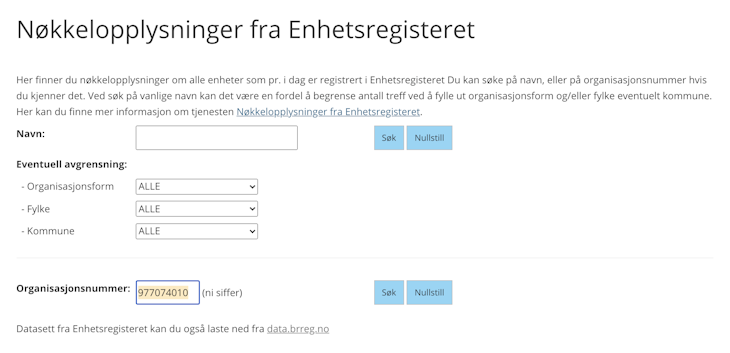

If you merely need to check a single customer, you can use an online form offered by the Norwegian Value Added Tax Register.

At the bottom of the page, you will find an input field labelled ‘Organisasjonsnummer’. Enter the organization number of your customer and click ‘Søk’ to submit.

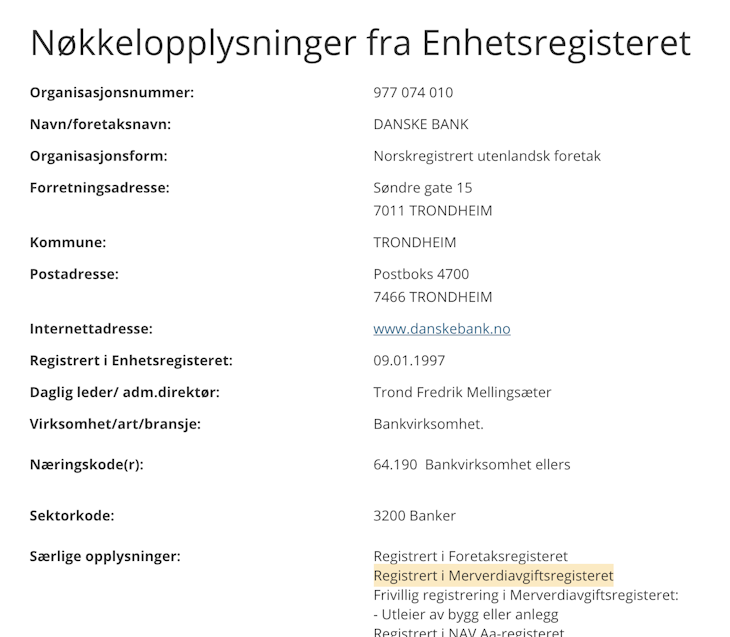

To check whether an organization is registered for VAT or not, you should look for the MVA registration status on the results page.

In the section ‘Særlige opplysninger’, find the indicator ‘Registrert i Merverdiavgiftsregisteret’ to ascertain VAT-registered status.

Check Automatically via API

With Vatstack’s VAT number check API, you can validate the business information of your customers in Norway in a batch.

Upon checkout, give your customer the possibility to enter a VAT number that you send to our API in real-time. Our API will automatically detect which government service it needs to send the request to based on the format.

In case of a Norwegian VAT number format, the information is validated against official government services in Norway.

This is how a JSON response looks like if you query Danske Bank’s VAT number 977074010MVA:

{

"id": "5e5a894fa5807929777ad9c7",

"active": true,

"company_address": "Søndre gate 15, 7011 TRONDHEIM",

"company_name": "DANSKE BANK",

"company_type": "NUF",

"consultation_number": null,

"valid": true,

"valid_format": true,

"vat_number": "977074010",

"country_code": "NO",

"query": "977074010MVA",

"type": "no_vat",

"requested": "2020-02-29T00:00:00.000Z",

"created": "2020-02-29T15:54:55.029Z",

"updated": "2020-02-29T15:54:55.029Z"

}The active boolean tells you whether the business exists and is actively trading or not. Look for the valid boolean to also check whether it is registered for VAT.

You can restrict validations to only Norwegian VAT numbers if you provide no_vat in the type body parameter of your validation request.

Norwegian VAT Number Format

Norway has a Central Coordinating Register for legal entities which registers basic data about a business. Upon registration, businesses are issued a unique ‘Organisasjonsnummer’ (organization number) which has 9 digits.

This organization number serves as the identifier of the business and will appear on all official documents issued both by the business itself and by government agencies such as the tax office.

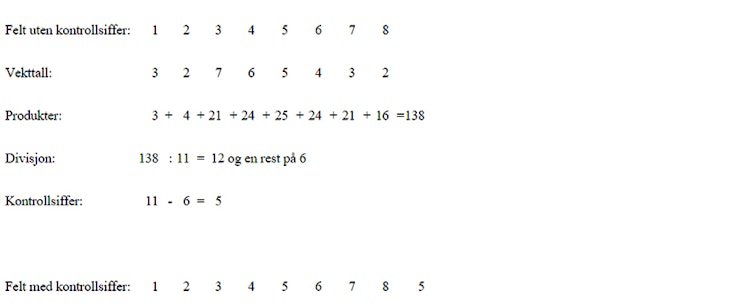

The technical construction of the number specifies that the first digit must always be either 8 or 9, with a modulus 11 check digit at the end.

According to the Central Coordination Register’s website, the weighting factors are 3, 2, 7, 6, 5, 4, 3 and 2 calculated from the first digit. The digits are thus multiplied by the weighting factors and the product sum divided by 11. The leftover from the division is subtracted by 11 and the result becomes the MOD11 checksum digit.

Businesses that are registered in the Value Added Tax Register are required to add the letters ‘MVA’ as a suffix to their organization number to indicate VAT registration.

MVA stands for ‘Merverdiavgift’, the Norwegian word for value-added tax. The VAT number format thus becomes:

- 999999999 (legal entity)

- 999999999MVA (VAT-registered legal entity)

Filing VAT Returns

VAT returns should be submitted on a bi-monthly basis while referencing the VAT number. VAT returns in Norway are due one month and ten days after the reporting period.

If your business is not established in Norway, you have to appoint a VAT representative residing in Norway to raise and issue all invoices on your behalf.