VAT Number Mass Validation in Bulk

Validate VAT numbers in bulk and automatically with our API. This bulk validation tool lets you query VAT numbers with various government services including the European Commission’s VIES and GOV.UK.

Grace TeoPublished October 7, 2020

You can validate VAT numbers manually on the VIES website or automatically with our API. As soon as you need to batch validate a large quantity of VAT numbers, a bulk validation tool would be the most recommended solution.

If you are considering mass validation, you may be in the following situation:

- You have a list of VAT numbers to validate in an Excel sheet or CSV file.

- Your customers are submitting VAT numbers on a daily basis.

- You don’t have the time to validate VAT numbers one at a time.

How to validate VAT numbers in bulk

To get started, you need an account with Vatstack. You can register an account if you don’t have one and follow the instructions to confirm your email address.

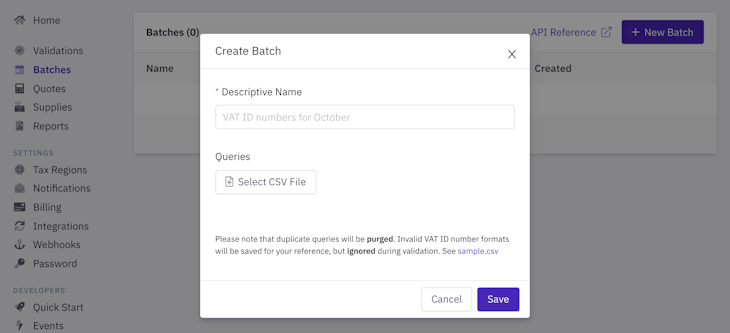

Navigate to Batches to create a new batch process and attach a CSV file containing your VAT numbers. A sample template to help you format the CSV file correctly is linked inside the modal dialog.

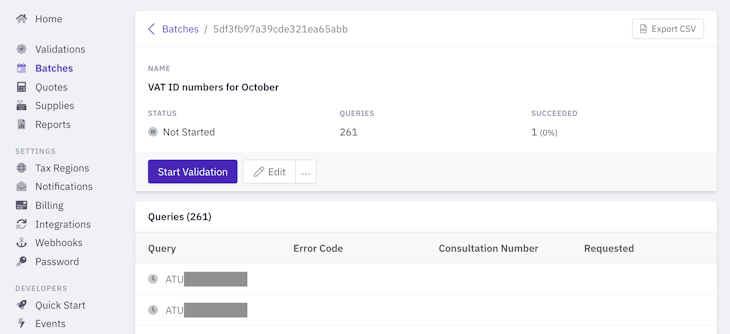

Once created, the batch screen will look like this:

Click the Start Validation button to start your batch process. Vatstack will run through your entire list in the background and notify you by email once the process is complete.

The finished report is downloadable in CSV which makes it easy for you to analyze results in a spreadsheet software. Your list will include all relevant information:

- VAT number

- Valid or invalid status

- A unique reference number and the requested date (acts as piece of evidence for tax administrations)

- Business name and address where available

- Country code

This is a big time-saver especially if you have to repeat this process regularly.

Note that developers can also utilize our API endpoints to run batch processes programmatically and listen to webhook events when a batch process completes.

Benefits to bulk VAT validation

You can quickly identify expired VAT numbers in the finished report and reach out to affected customers.

If a VAT number was officially de-registered for whatever reason but you fail to reflect this on your invoices, then you face a situation whereby you owe VAT to your tax administration that you have not collected from your customer. This could be picked up with the EC Sales List (ESL) filed quarterly.

It is therefore in your best interest to keep your records accurate and run such a bulk validation regularly, and at least every quarter before filings are due. We recommend implementing a re-validation process especially to businesses with repeat customers.

Our batch processes were built to ease your bureaucratic burdens as much as possible.